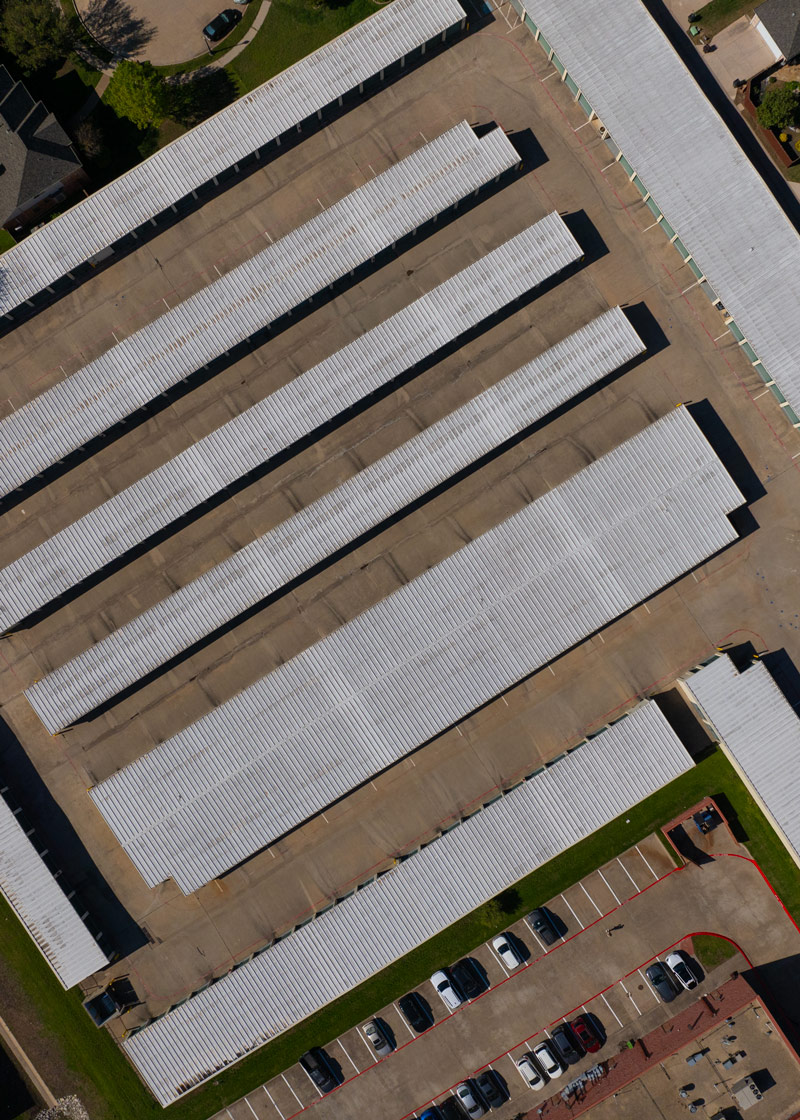

Your Strategic Partner in Buying and Selling Self Storage Investments

Unlock the Value of Your Self-Storage Property with Alpine West Group's Expert Acquisition Team

At Alpine West Group, we specialize in acquiring self-storage properties, focusing on enhancing value and generating stable, long-term returns. Our targeted acquisition strategy is designed to identify properties that not only meet but exceed our rigorous investment criteria.

Top 5 Reasons Sellers Sell

- I’m Tired

- I want to Retire

- I want to Travel

- I want to leave something for my grandkids

- I have a family member managing it who isn’t doing well and I don’t have the heart to let them go

Our Approach

Deciding to sell a self-storage property can be a daunting task, particularly when considering the potential tax implications. Fortunately, you have several options to minimize these costs.

When selling self-storage property, the tax code provides various planning strategies that can significantly reduce expenses, such as capital gains taxes. Here’s a look at how you can navigate these options effectively.

Property owners may be surprised to find that their tax liability could exceed the current 20% federal capital gains tax rate, in addition to state taxes. “Understanding the full range of options and tax implications available when selling a self-storage property is crucial,” Jones explained. “A 1031 exchange is not always the best solution for addressing tax issues.”

For example, a California property owner with a $5 million property and a taxable gain of $3.5 million would face $1.07 million in capital gains taxes.

If they opted for a traditional sale, they would end up with $2.1 million after paying off debt and taxes. However, by strategically using the tax code, the owner could eliminate these taxes entirely and receive $2.93 million tax-free for reinvestment.

This result was achieved by combining two established tax planning strategies. This approach allowed the seller to lawfully reduce the taxable capital gain from 100% to just 1%, while enjoying additional tax savings, maintaining full control over the sale proceeds, and protecting these assets from creditors and estate taxes. Notably, this is the same strategy Mark Zuckerberg employed for his Facebook stock before its public offering.

It’s important to recognize that these tax laws, crafted by Congress, are available to everyone when applied correctly, not just billionaires.

Why Sell Your Self-Storage Property to Alpine West Group?

- Expertise in Self-Storage: With years of industry experience and a deep understanding of market dynamics, Alpine West Group is a leading player in the self-storage sector. We use our expertise to improve and optimize every property we acquire.

- Simplified Transaction Process: We know that selling your property can be stressful. That's why we've streamlined our acquisition process to make it as smooth and straightforward as possible. Our team works closely with you to ensure a seamless transition with minimal disruption.

- Commitment to Growth: We are committed to the long-term growth of our self-storage portfolio. By acquiring properties across various locations, we are continuously expanding our footprint and enhancing our operational efficiencies.

- Financial Strength: Alpine West Group has the capital resources and industry connections to close deals quickly and efficiently. Our strong financial backing ensures that we can offer competitive pricing and flexible terms that meet the needs of property owners.

How It Works

Property Evaluation

Offer and Negotiation

Seamless Transition

Partner with Us

If you own a self-storage facility and are considering selling, Alpine West Group is here to discuss your options. Our approach is centered on creating mutually beneficial transactions that respect the legacy of what you’ve built while positioning the property for future success.

Contact us today to learn how partnering with Alpine West Group can unlock the full potential of your self-storage investment.