Commonly Asked Questions

What is an Engineered Cost Segregation Study?

A cost segregation study is a set of calculations created by an independent firm with extensive tax and construction knowledge. At CSSI®, we create an engineering-based cost segregation study by analyzing your building and its assets within U.S. tax code guidelines. When an engineering-based study is performed, actual cost records and construction documents are reviewed, when available, and a site visit is completed.

A quality cost segregation study should include the 13 points outlined within U.S. tax code. Our methodical approach identifies individual components of your commercial property, which are included in your detailed cost segregation study.

Why is cost segregation not more commonly known?

Does my property qualify for a Cost Segregation Study?

What benefits can I expect from a Cost Segregation Study by Alpine West Group?

When is the ideal time to conduct a Cost Segregation Study?

What information is necessary to perform a Cost Segregation Study?

How is a Cost Segregation Study conducted?

Why should I opt for a Cost Segregation Study from Alpine West Group?

With Alpine West Group, you’re working with an independent firm with extensive tax and construction knowledge. We create an engineering-based cost segregation study by analyzing your building and its assets within U.S. tax code guidelines. When an engineering-based study is performed, actual cost records and construction documents are reviewed, when available, and a site visit is completed. We provide a quality cost segregation study that includes the 13 points outlined within U.S. tax code. Our methodical approach identifies individual components of your commercial property, which are included in your detailed cost segregation study.

What is the duration for completing a Cost Segregation Study with Alpine West Group?

What support does Alpine West Group provide in the event of an audit?

Can I initiate a Cost Segregation Study on a property that is still under construction?

Why choose Alpine West Group for your Cost Segregation Study?

Why is an estimate beneficial while evaluating a purchase?

Allows you to determine unlocked benefits not seen at surface level.

Who can benefit from our engineered cost segregation studies?

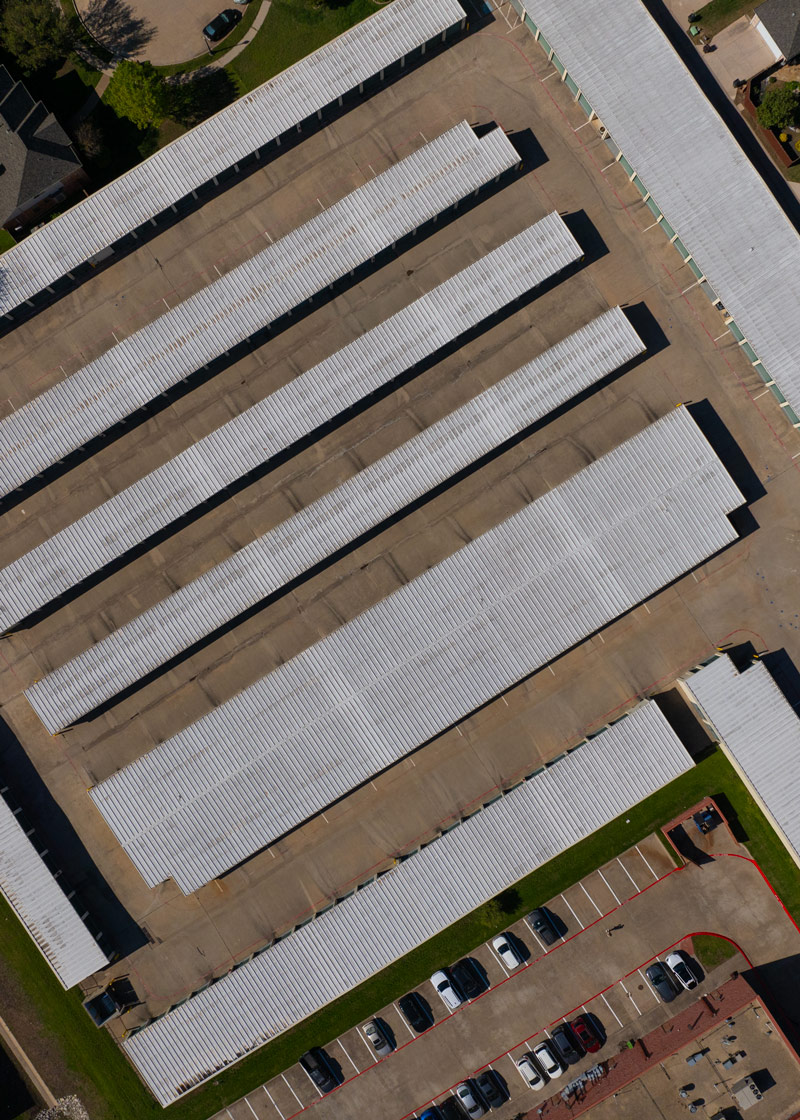

Our meticulous studies are particularly beneficial for self-storage facility and commercial property owners, enabling them to accelerate the depreciation of specific elements like security systems and outdoor lighting. Commercial building owners find value in segregating costs associated with tenant improvements and fixtures, which can lead to considerable tax relief. Additionally, landlords of both short-term vacation rentals and long-term residential properties can depreciate appliances, interior finishes, and other personal property faster, enhancing their investment returns.

Each cost segregation study is conducted with an unwavering commitment to detail and compliance, ensuring every possible tax advantage is realized while maintaining adherence to IRS guidelines. This thorough process not only maximizes benefits but also protects against potential compliance issues, securing your investment’s profitability for years to come.